24+ lock in period mortgage

Comparisons Trusted by 55000000. Protect Yourself From a Rise in Rates.

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

They quote rates assuming a 30-day lock.

. Web With most lenders the standard lock period is 30 days. Lock Your Rate Today. A 1 difference in interest rates results in the payment of an additional 60 with each months mortgage payment.

Web Lock-ins of 30 to 60 days are common. Get Instantly Matched With Your Ideal Mortgage Lender. Ad 10 Best House Loan Lenders Compared Reviewed.

But some lenders may offer a lock-in for only a short period of time for example 7 days after your loan is approved while. The mortgage lender guarantees with a few. Web Step 1.

Ad Take Advantage Of Low Rates Now - Get Started. Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Ad Calculate Your Payment with 0 Down. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified time. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve. Multiply your current interest rate by the number of months remaining on your current term. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web A mortgage rate lock is when your lender guarantees to set your loan at a specific fixed rate even if market interest rates change before your loan closes. Save Real Money Today. Comparisons Trusted by 55000000.

That comes to 720. Web Mortgage locks can be available for 30 45 or 60 days. The lengthier the term the longer you keep the conditions of your current mortgage contract.

Subtract the number of months of. This means you wont need to worry about rates going. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Ad Top Home Loans. Get Instantly Matched With Your Ideal Mortgage Lender. If your rates jump 5 during that period.

Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Web A rate lock freezes the interest rate on a mortgage usually for a fee paid when you agree to the terms of the loan. Ad 10 Best House Loan Lenders Compared Reviewed.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. You may be able. For example your lender might lock in your interest rate at 375 percent for 45 days.

By locking 7 to 15 days before closing you should get better pricing. Locks are usually in. Web A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases.

55 x 24 months 132. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. Web Longer-term mortgages are mortgages with a term greater than 5 years.

Lock Your Rate Today.

S 1

Generation Mortgage Associates Your Preferred Local Lender

Outlook For 2018 You Can Get What You Need Kkr

Mortgage Rate Locks Everything You Need To Know Bankrate

Average Transaction Price For New Vehicles Hits Record 45 844 In June As Consumer Still Pay No Matter What Amid Inventory Shortages Record Per Unit Gross Profits At Dealers Wolf Street

Ws Jan 24 2014 By Weekly Sentinel Issuu

Frb A Consumer S Guide To Mortgage Lock Ins

Cpi Definition Financial Dictionary Fxmag Com

How Long Can You Lock In A Mortgage Rate Rate Lock Guide

Bear Market Definition Financial Dictionary Fxmag Com

Credit Freeze Vs Credit Lock Know The Difference Moneytap

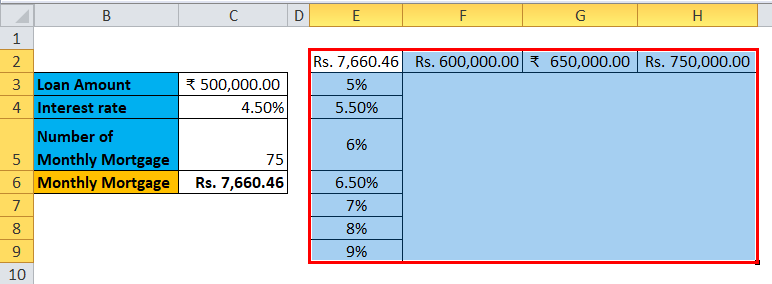

Data Table In Excel Types Examples How To Create Data Table In Excel

Things To Consider While Refinancing Your Home Loan Moneytap

What Is A Rate Lock Period Maestro

Form 8 K Boa Acquisition Corp For Dec 02

What Is A Mortgage Rate Lock Moneytips

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word